Quickbooks Integration Guide

This is a multi-step guide on how to configure the integration between Fohlio and Quickbooks.

After completing it, you and your team will gain knowledge on:

* How to configure Procurement Settings in order to have a correct data flow.

* How to send & sync documents from Fohlio to Quickbooks Online.

* The answers to the most common questions related to the integration.

* How to identify and troubleshoot various problems.

With our integration you can:

- Keep a close eye on your cash flow.

- Track invoices, payments, purchases, and more by syncing your Fohlio account with QuickBooks Online.

Sections

-

Connecting to Quickbooks

-

Setting up the Tax Agency for Tax Rates in Fohlio

-

Mapping the Chart of Accounts

-

Sending documents from Fohlio to Quickbooks

-

Optional: Linking your Fohlio project to a Quickbooks project

-

Bonus: Frequently Asked Questions

-

Bonus: Troubleshooting Guide

Connecting to Quickbooks

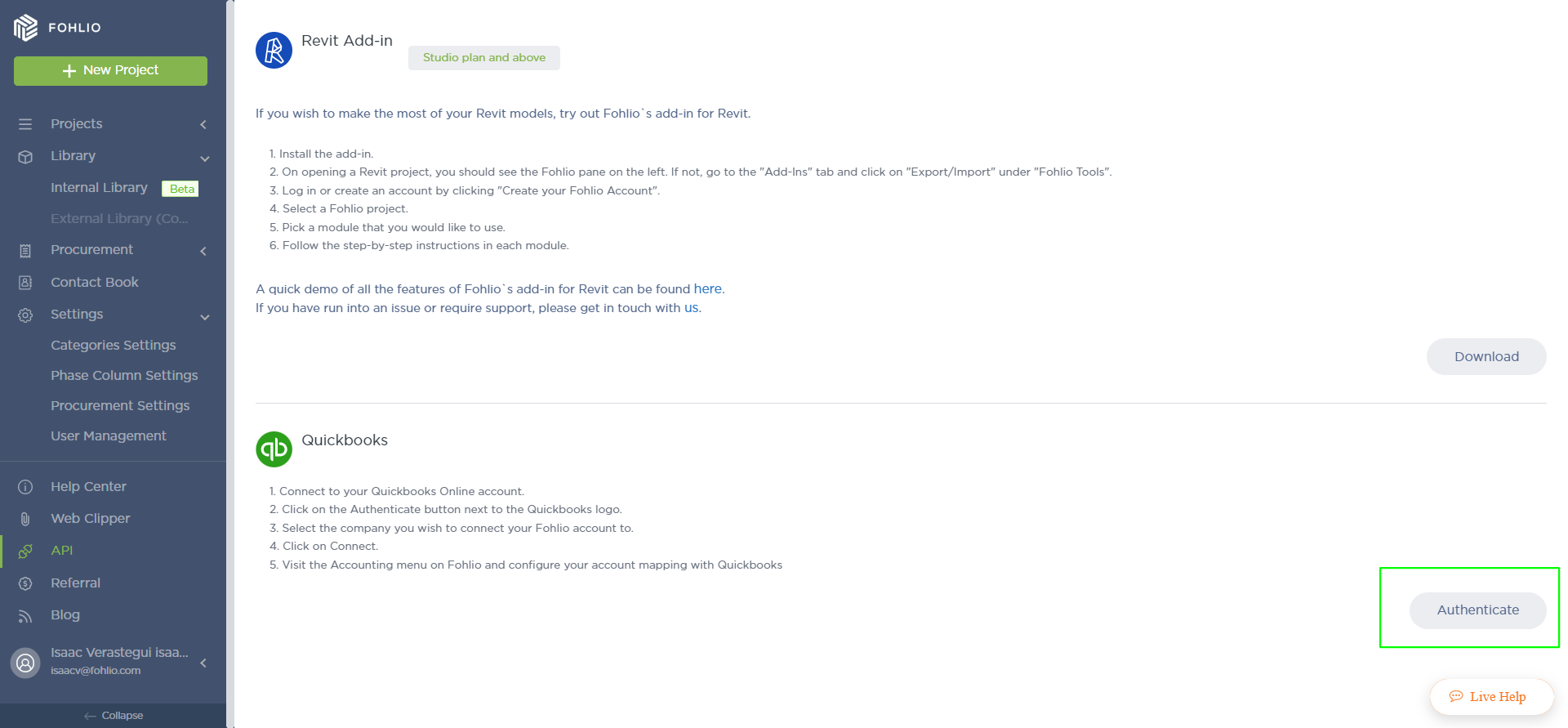

The first step in configuring the integration between Fohlio and Quickbooks is you need to connect your Fohlio account to your Quickbooks account.

1. Upon clicking on Authenticate, you will be redirected to Quickbooks.

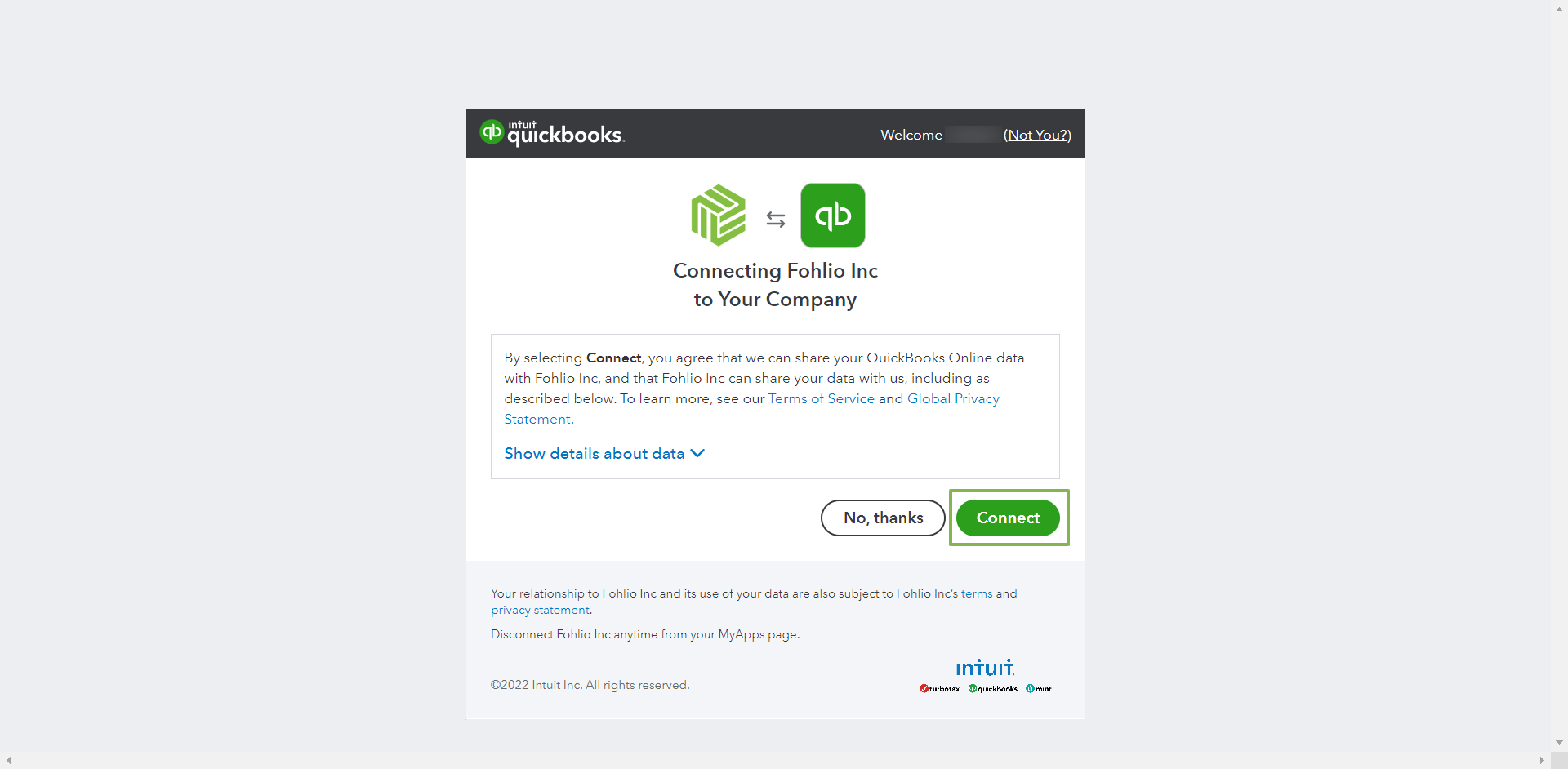

2. You will have to select the Company and click on Connect

Note: If you are not signed in on Quickbooks, you will first be prompted to sign in.

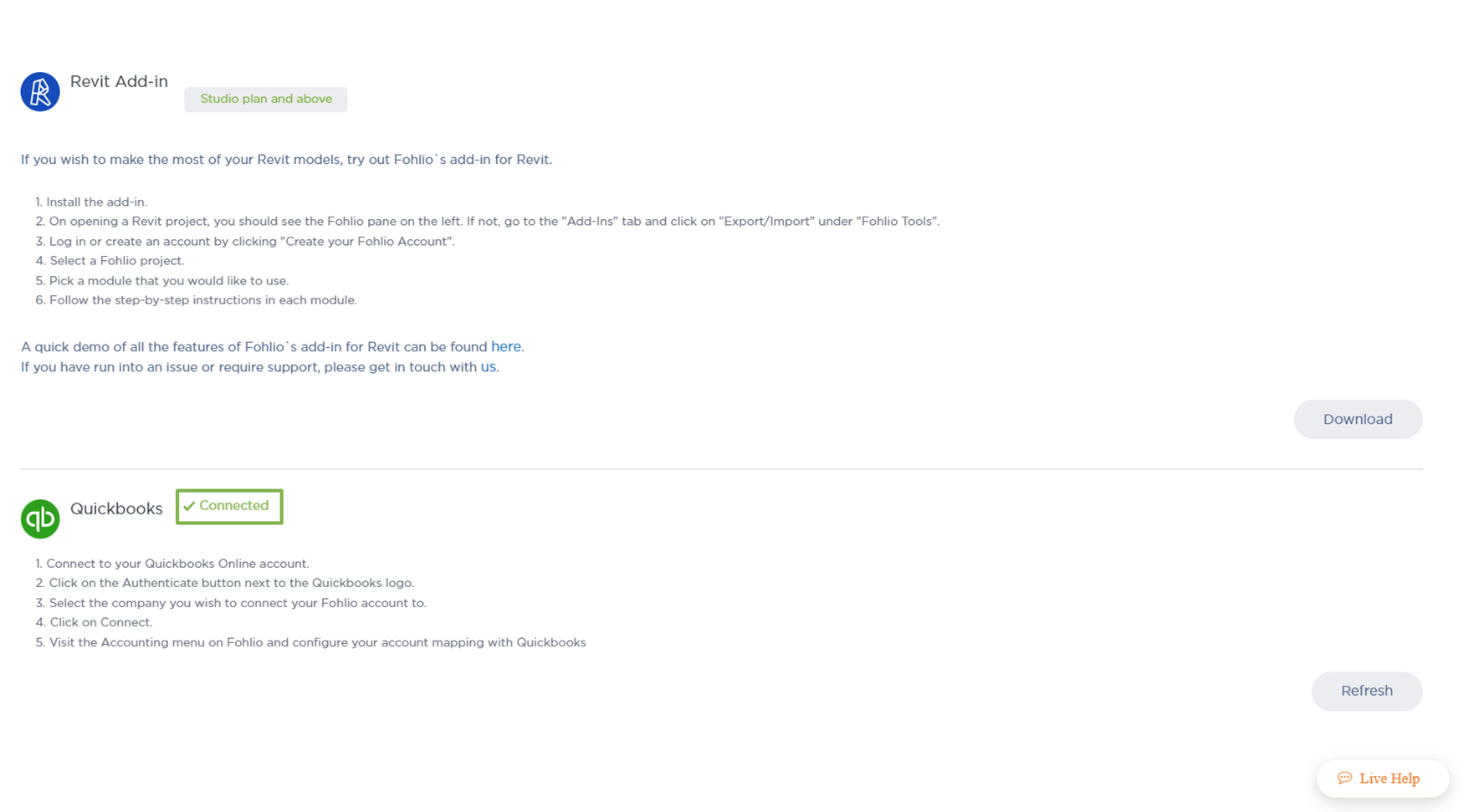

Once your account is connected to Quickbooks, you will be redirected to Fohlio and the status of the connection will be updated.

Setting up the Tax Agency for Tax Rates in Fohlio

The next step after connecting to Quickbooks is to configure the settings, on average, it takes around 5 minutes to set it up.

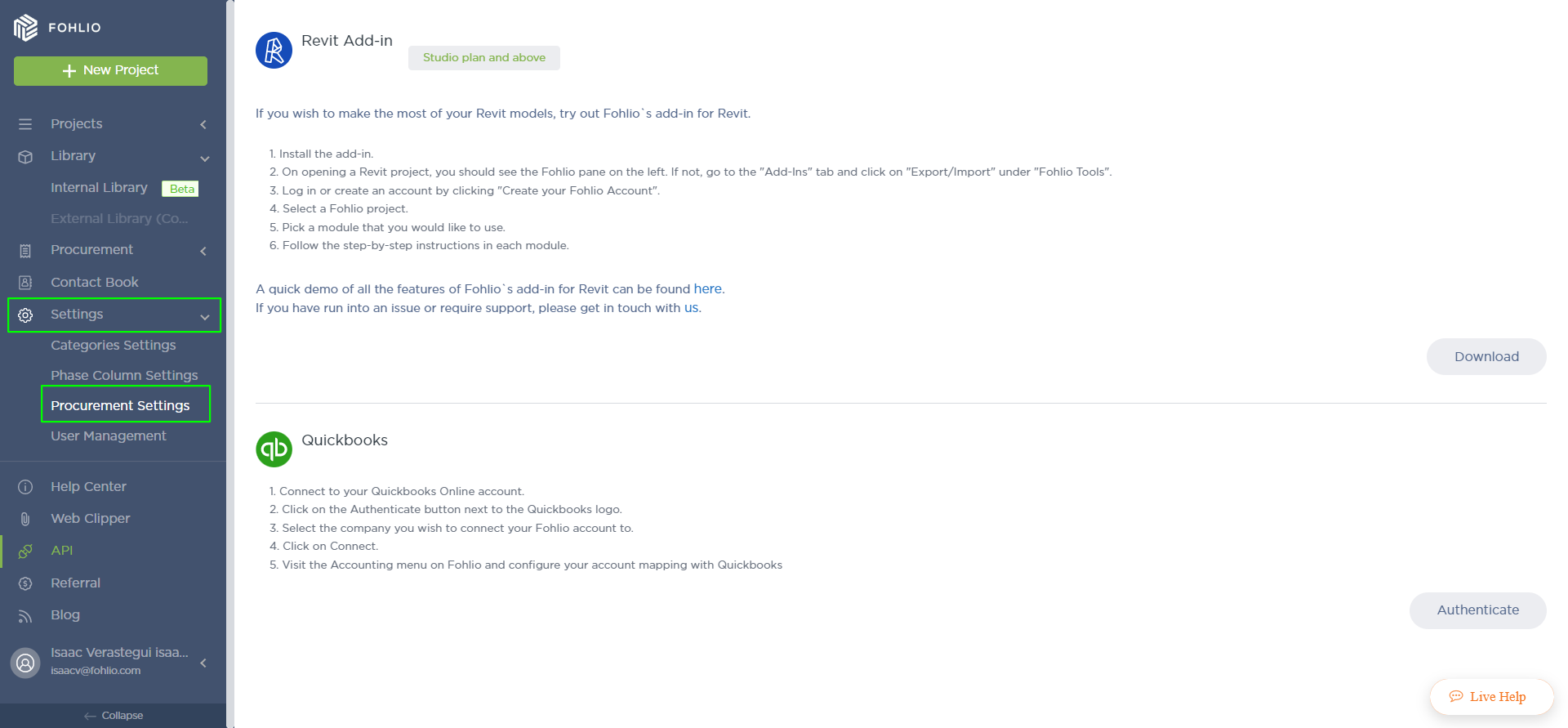

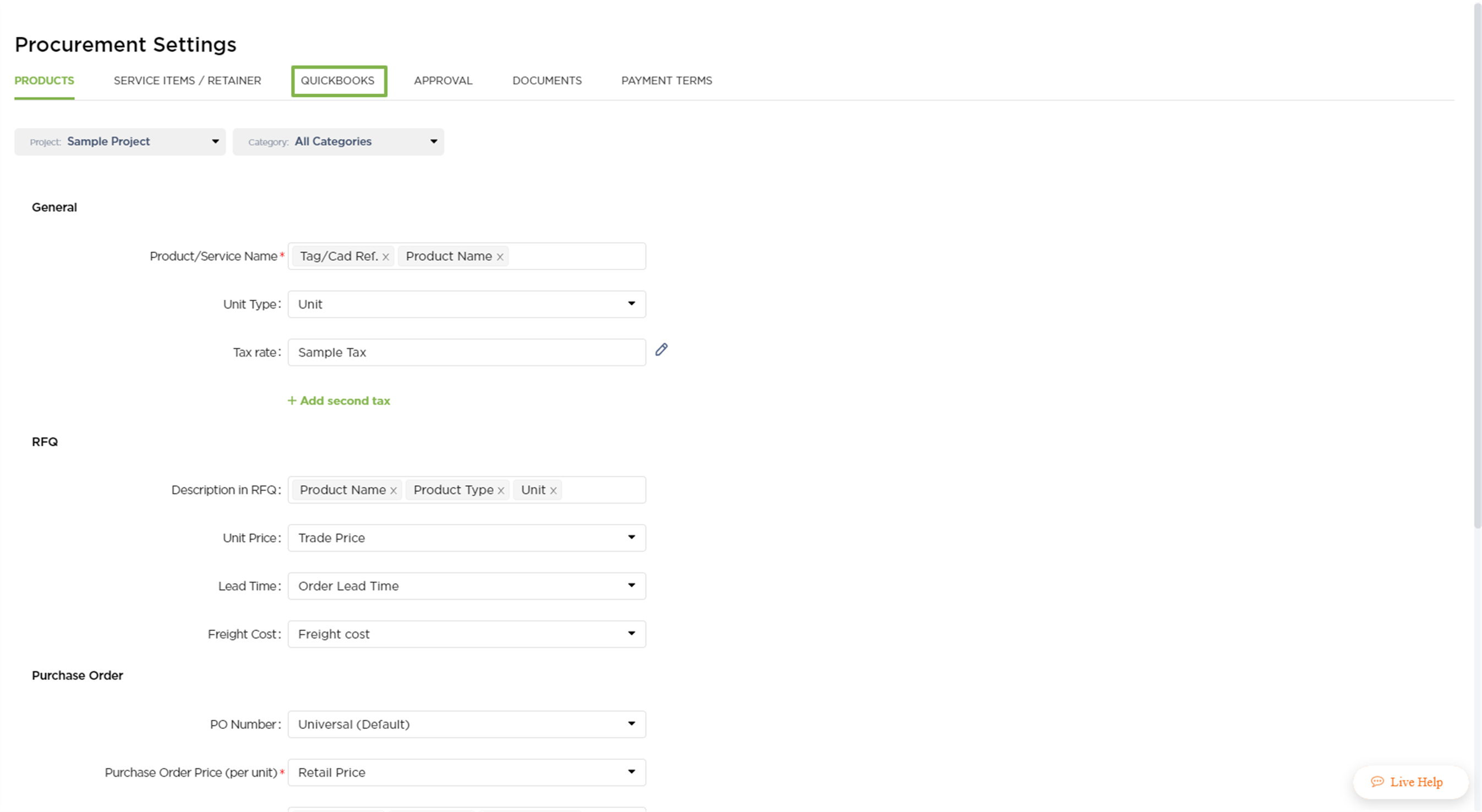

1. Click on Procurement from the navigation sidebar and then click on Settings

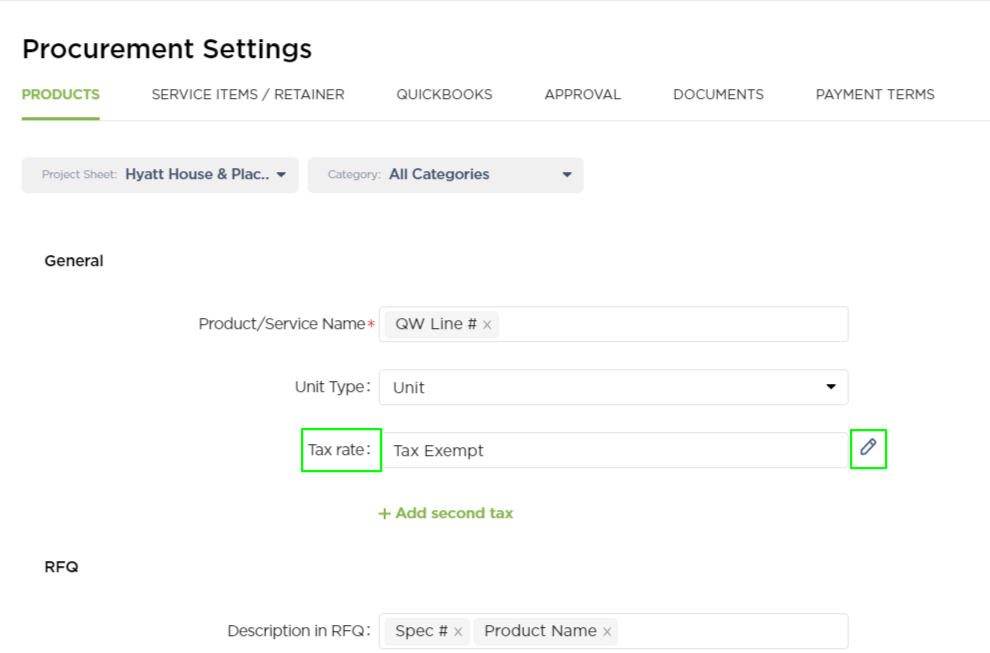

2. In the General section of the Products tab, we are able to configure the Tax Rate that is used for the selected project.

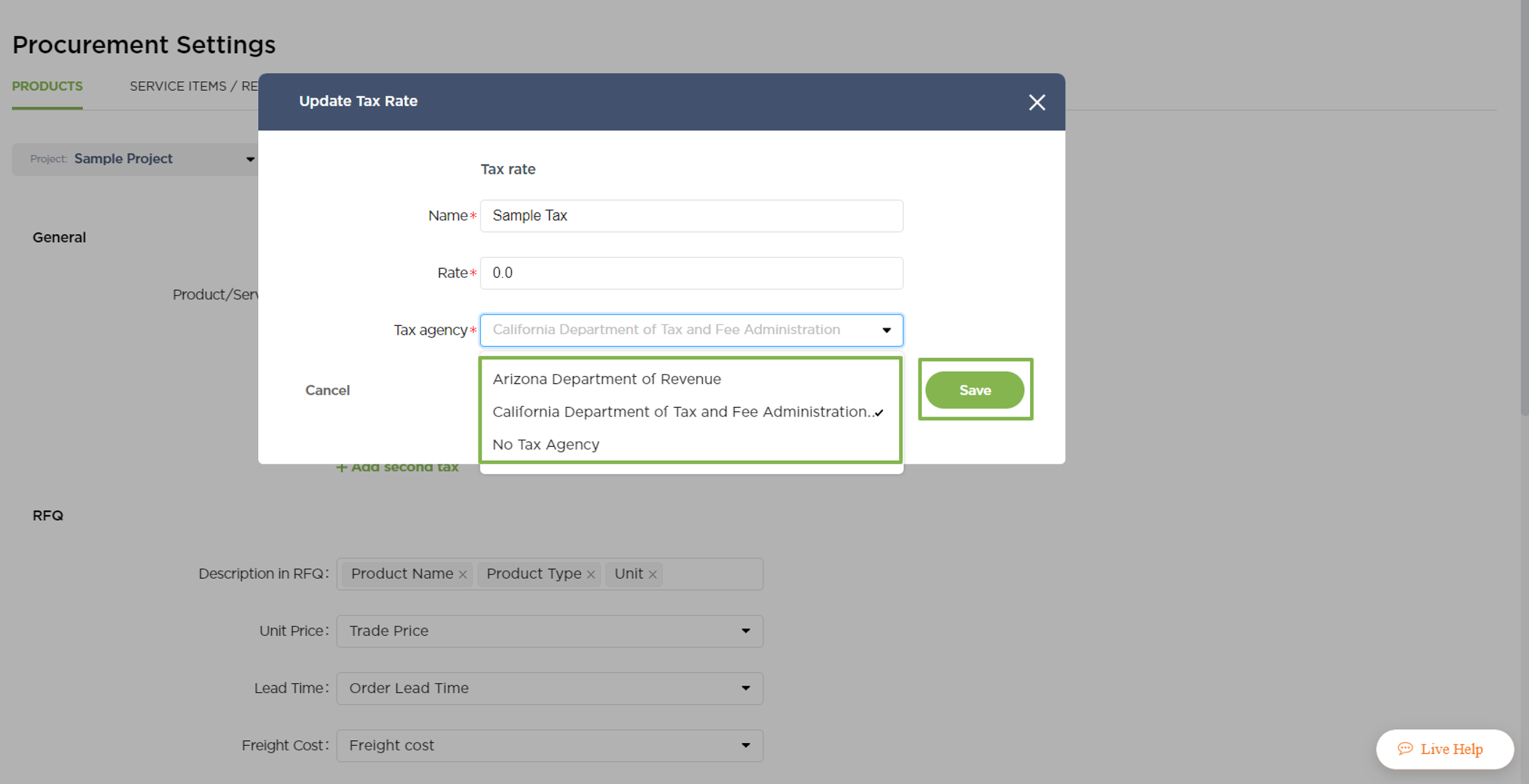

Here we need to click on the Edit and select one of the Tax Agencies available

-

The list of Tax Agencies comes from your Quickbooks configuration on the Taxes page.

-

The settings are per project, meaning that you can use a different Tax Rate for each project.

-

In case there are no Tax Rates created for your account, you can create a new one by following this tutorial

The list of Tax Agencies comes from your Quickbooks configuration on the Taxes page.

The settings are per project, meaning that you can use a different Tax Rate for each project.

In case there are no Tax Rates created for your account, you can create a new one by following this tutorial

3. The last thing that needs to be done is to save the changes, click on Save from the Update Tax Rate window and then click on Save at the bottom of the Products tab.

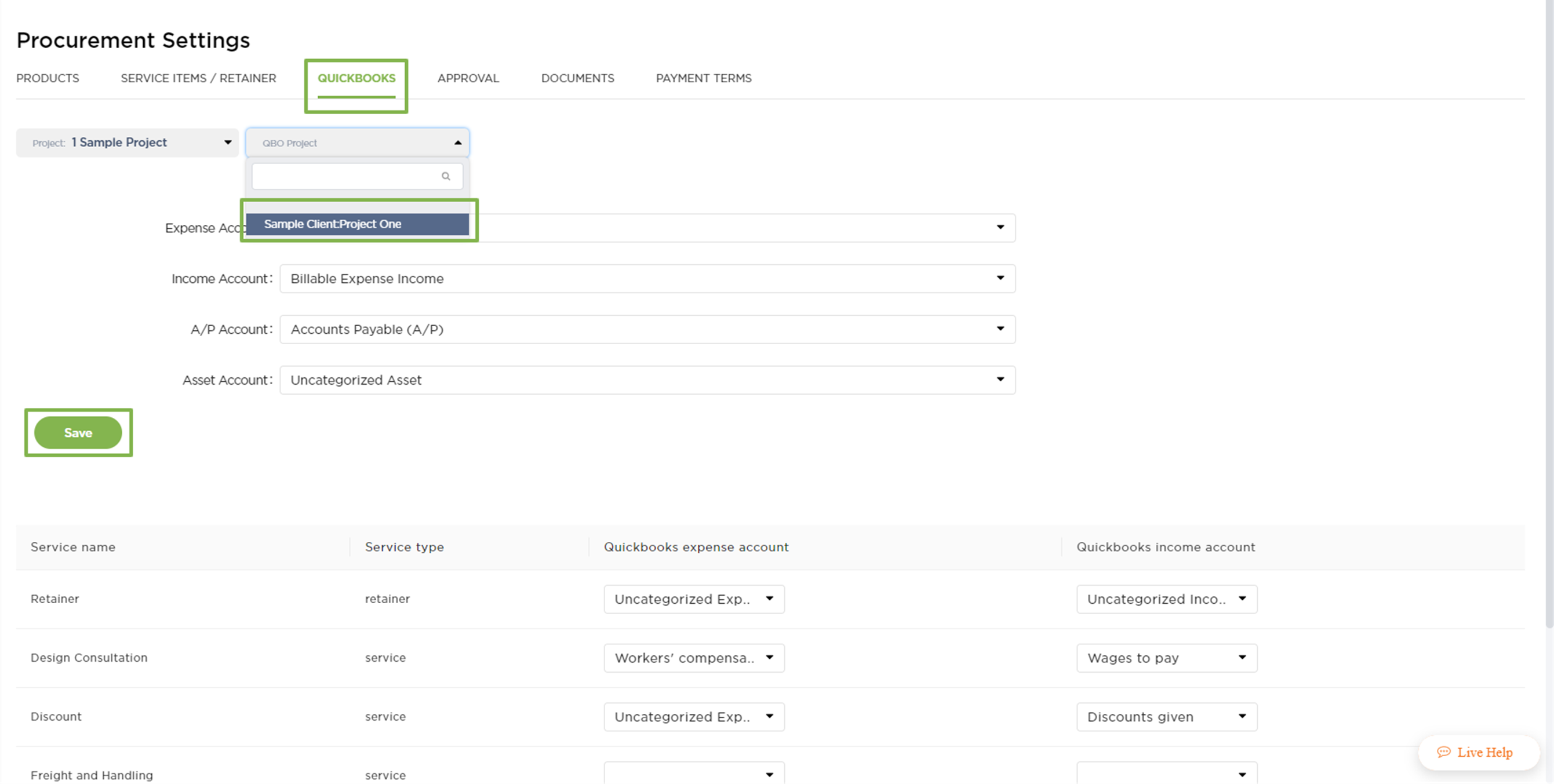

Mapping the Chart of Accounts

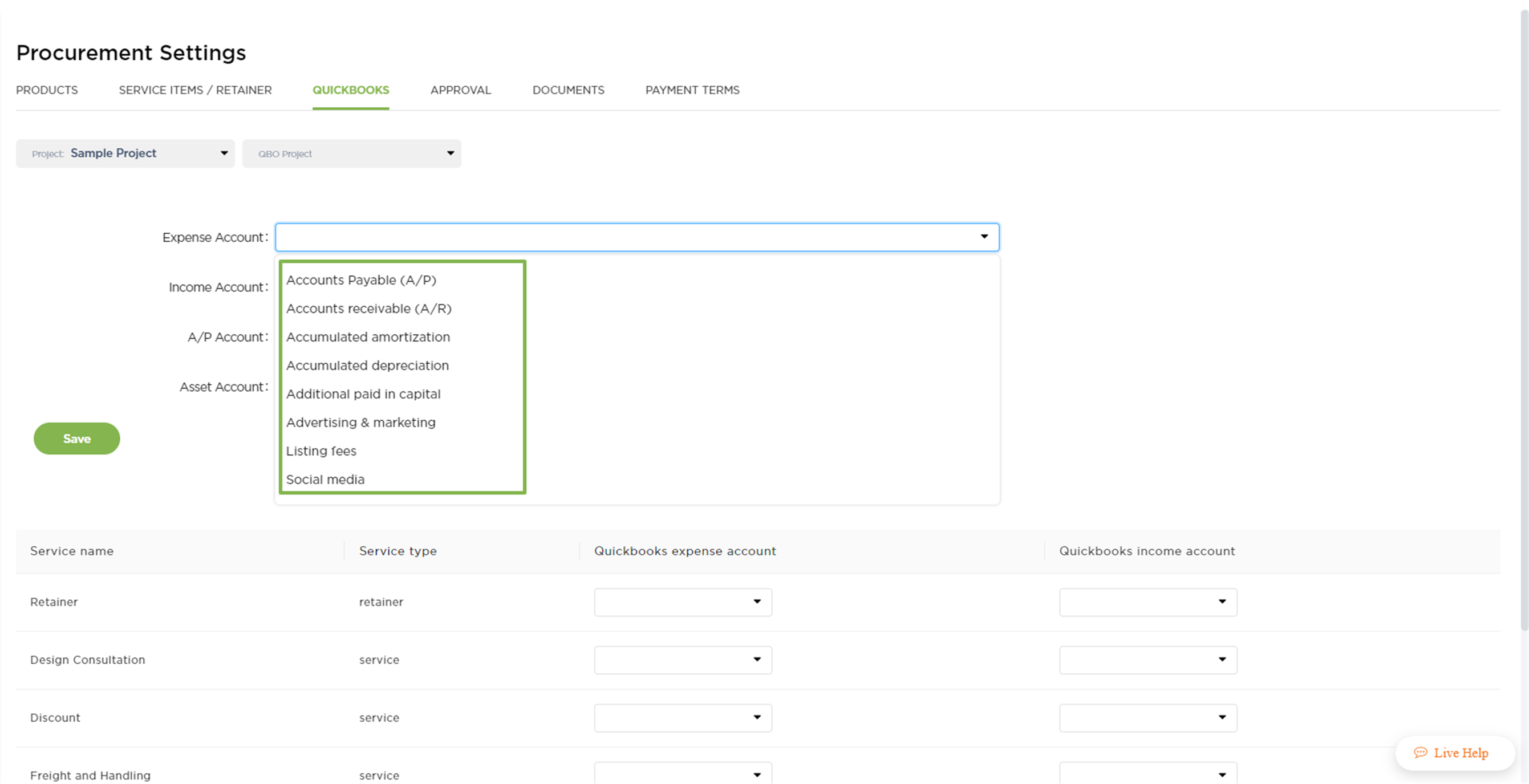

In order to ensure that each income and expense is tracked accordingly, we need to select which Accounts are going to be used for your transactions.

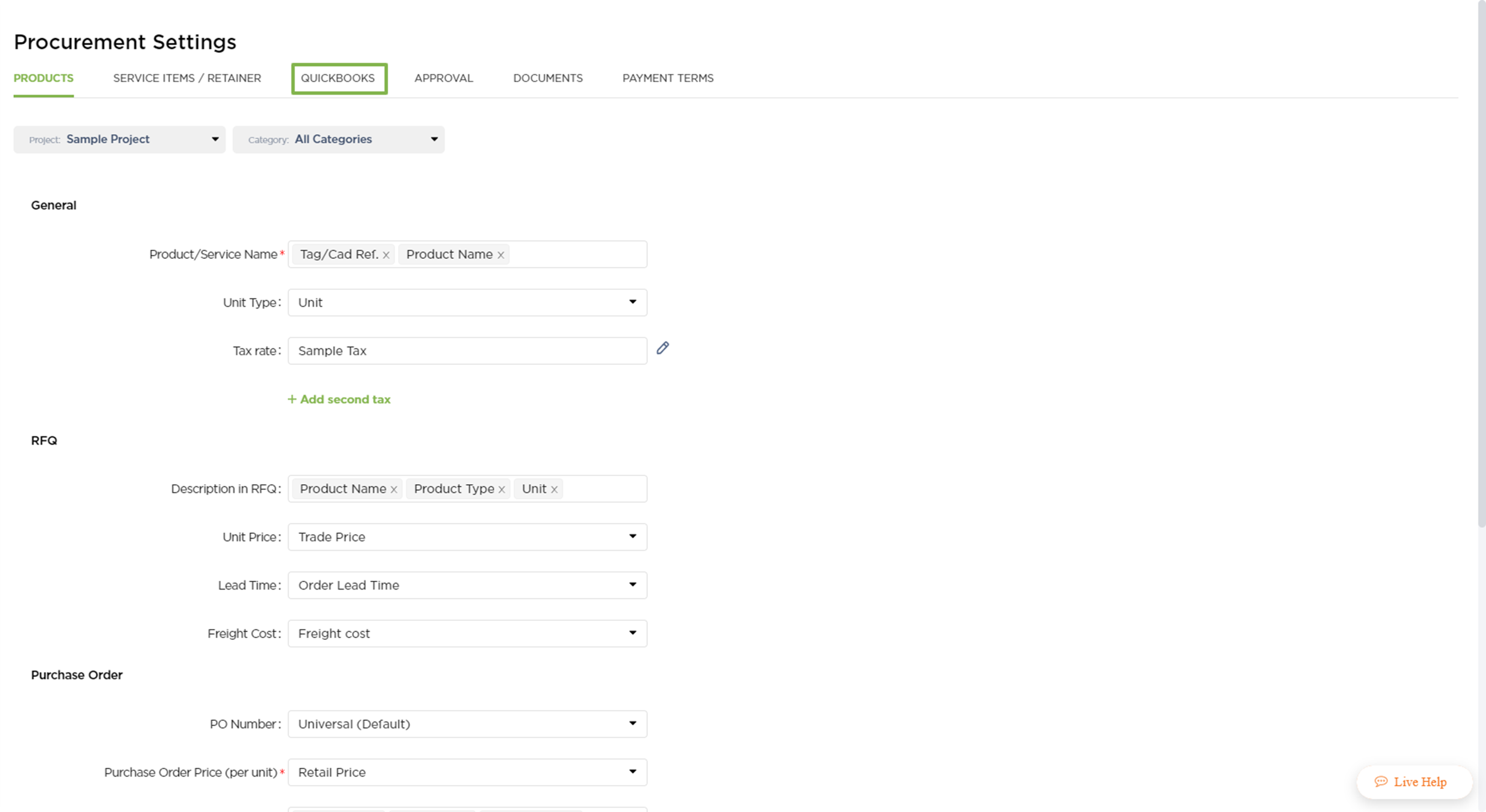

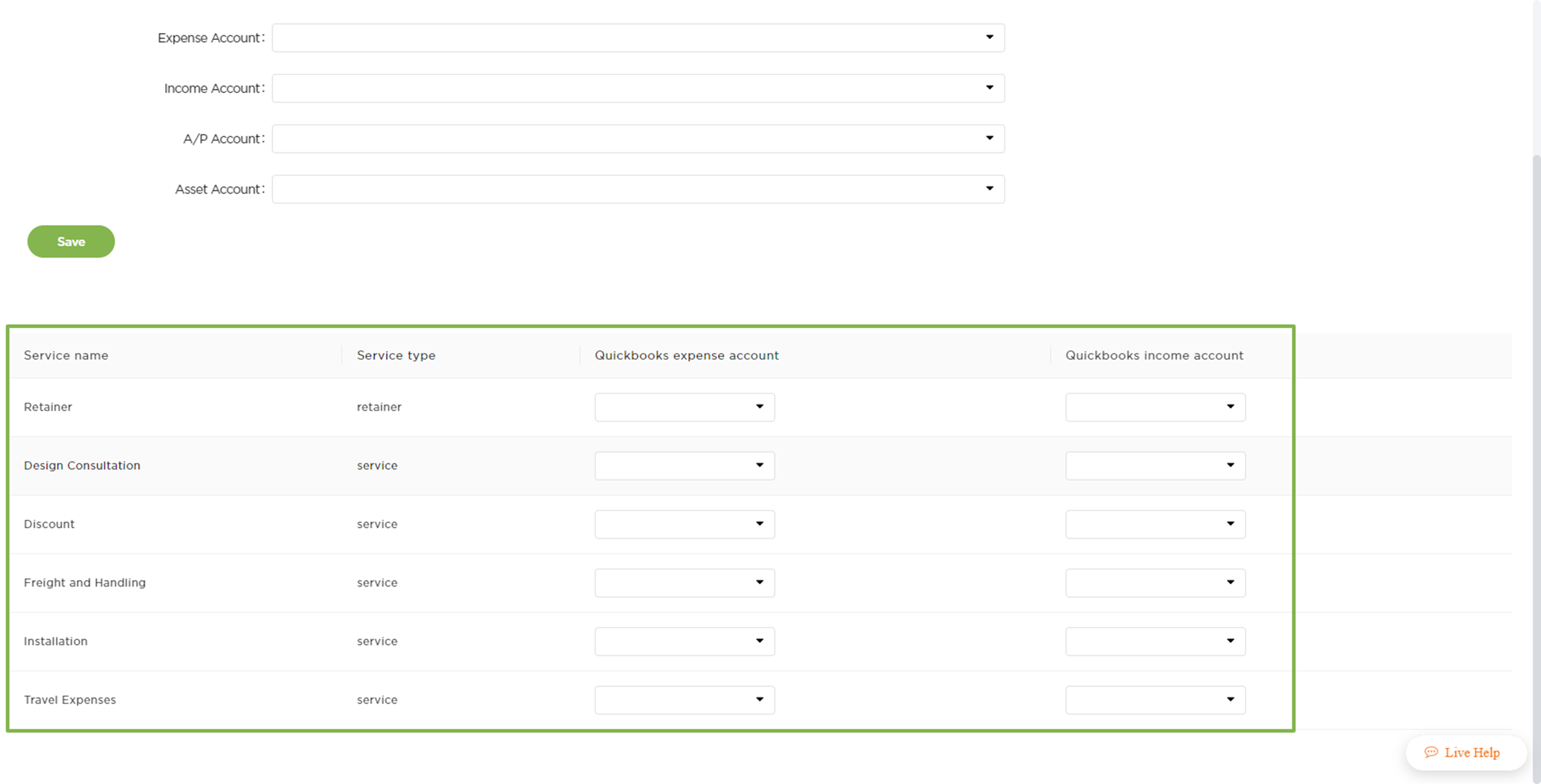

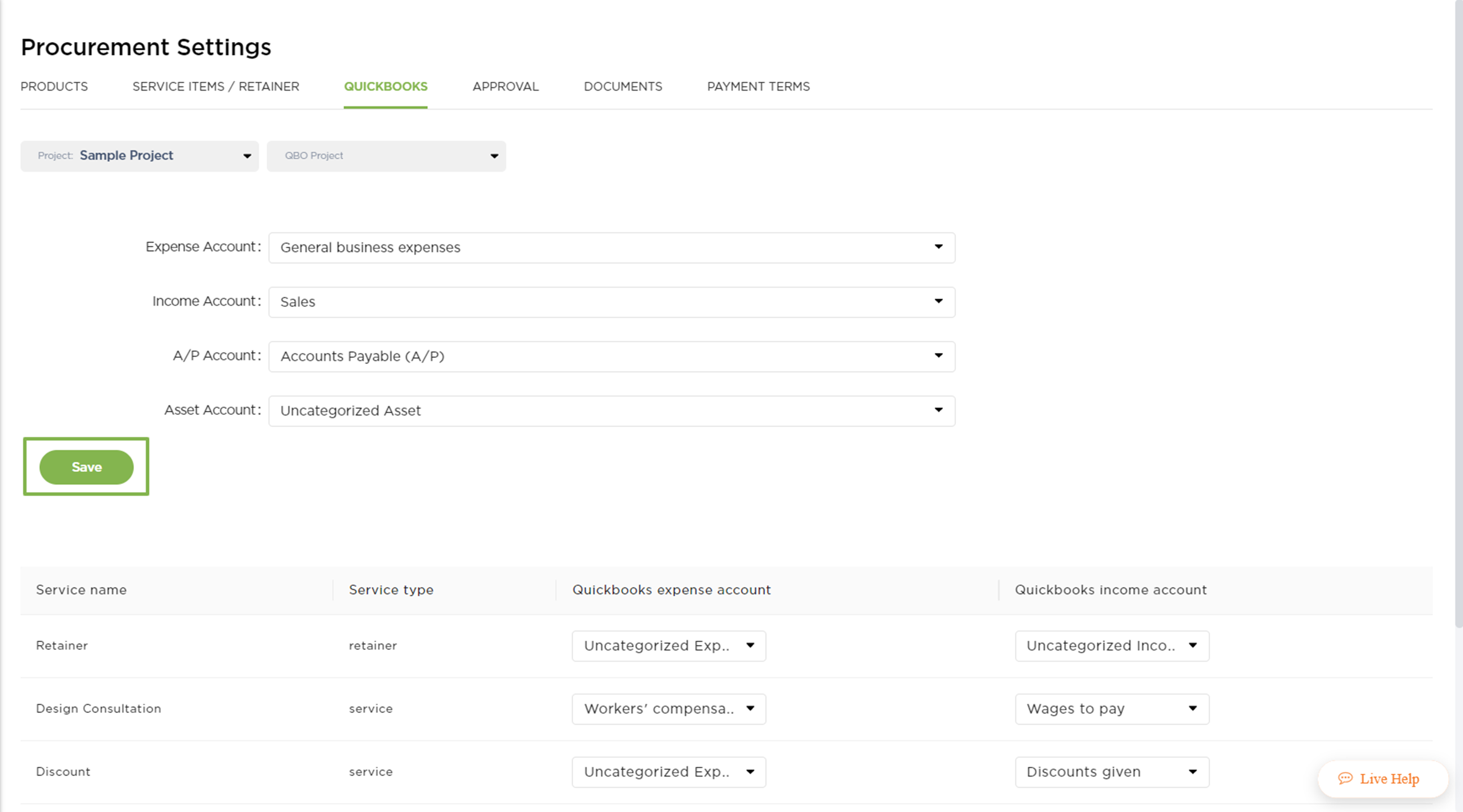

1. Access the Quickbooks tab on the Procurement Settings page.

2. You will need to select an account from the dropdown list for each available account type.

-

Ensure that the account type matches on Quickbooks.

Ensure that the account type matches on Quickbooks.

-1.png)

3. Optional: The same step can be followed for the list of services (if your team will use them on Client Proposals and Client Invoices)

4. The last step is to Save the settings.

Sending documents from Fohlio to Quickbooks

Note: We do recommend creating a new document (Client Proposal, Client Invoice, or Purchase Order) for testing purposes.

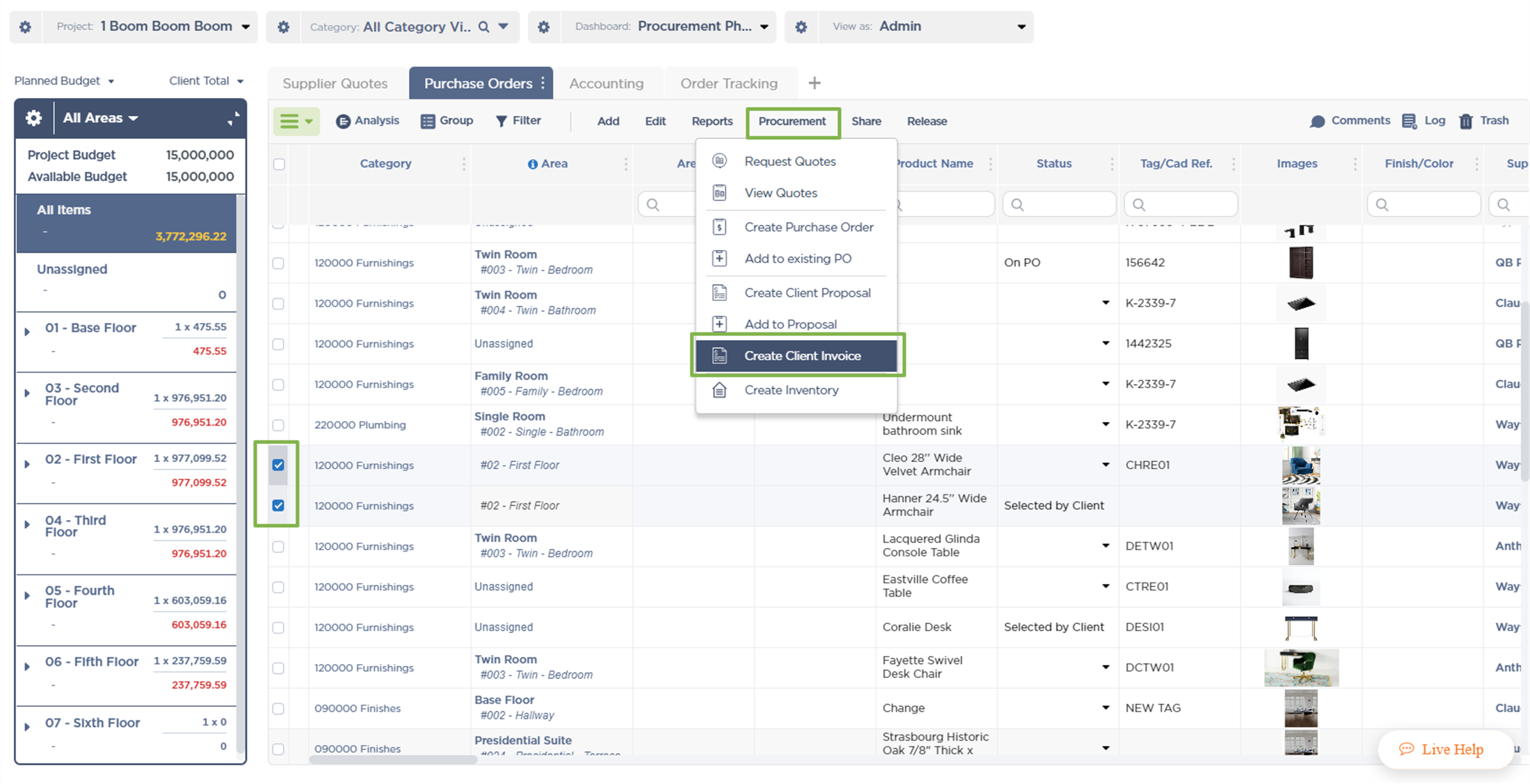

1. Create a new document (ie. a Client Invoice) by clicking on Procurement and then on Create Client Invoice

Note: An existing newly created document could also be used.

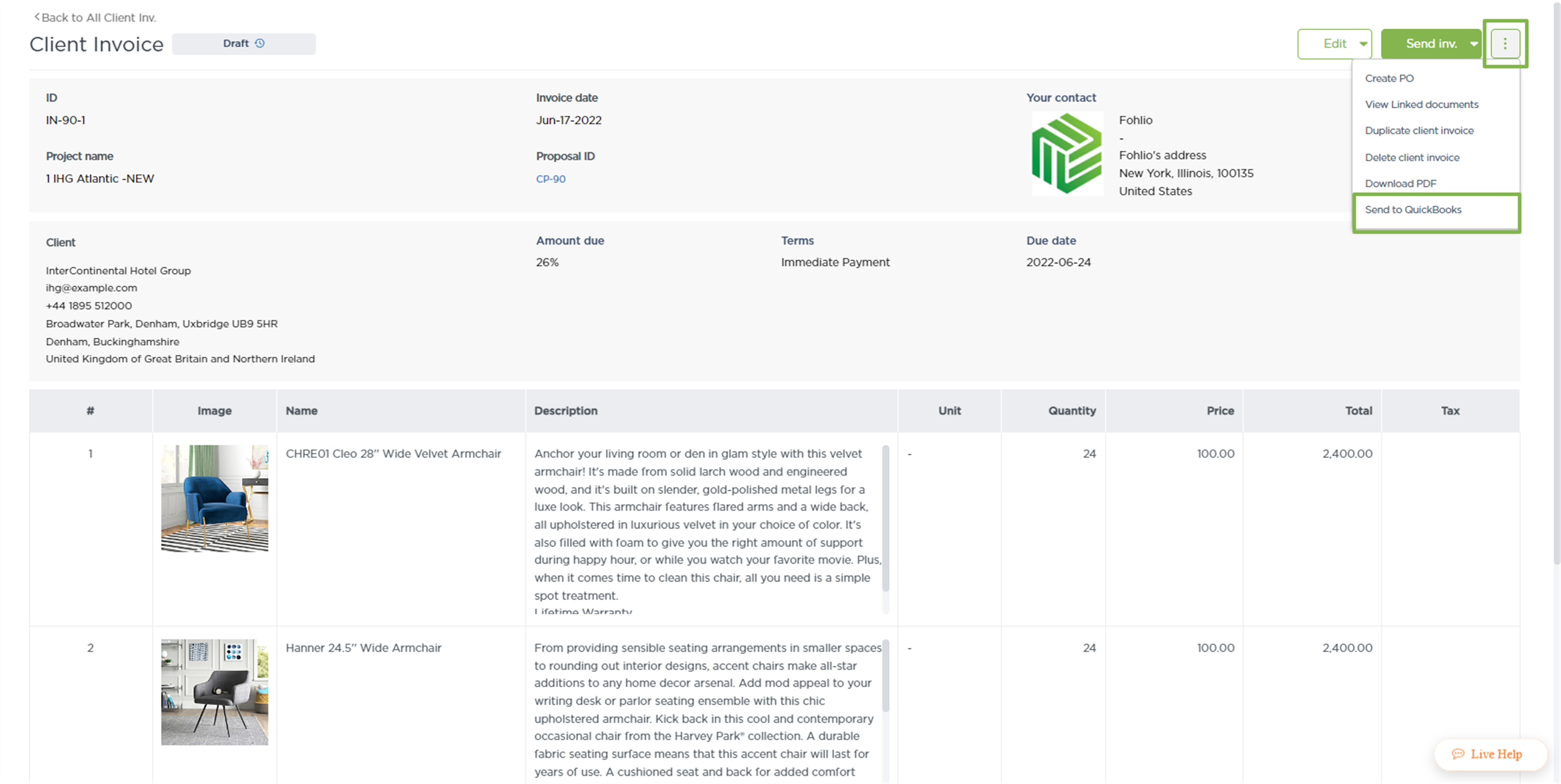

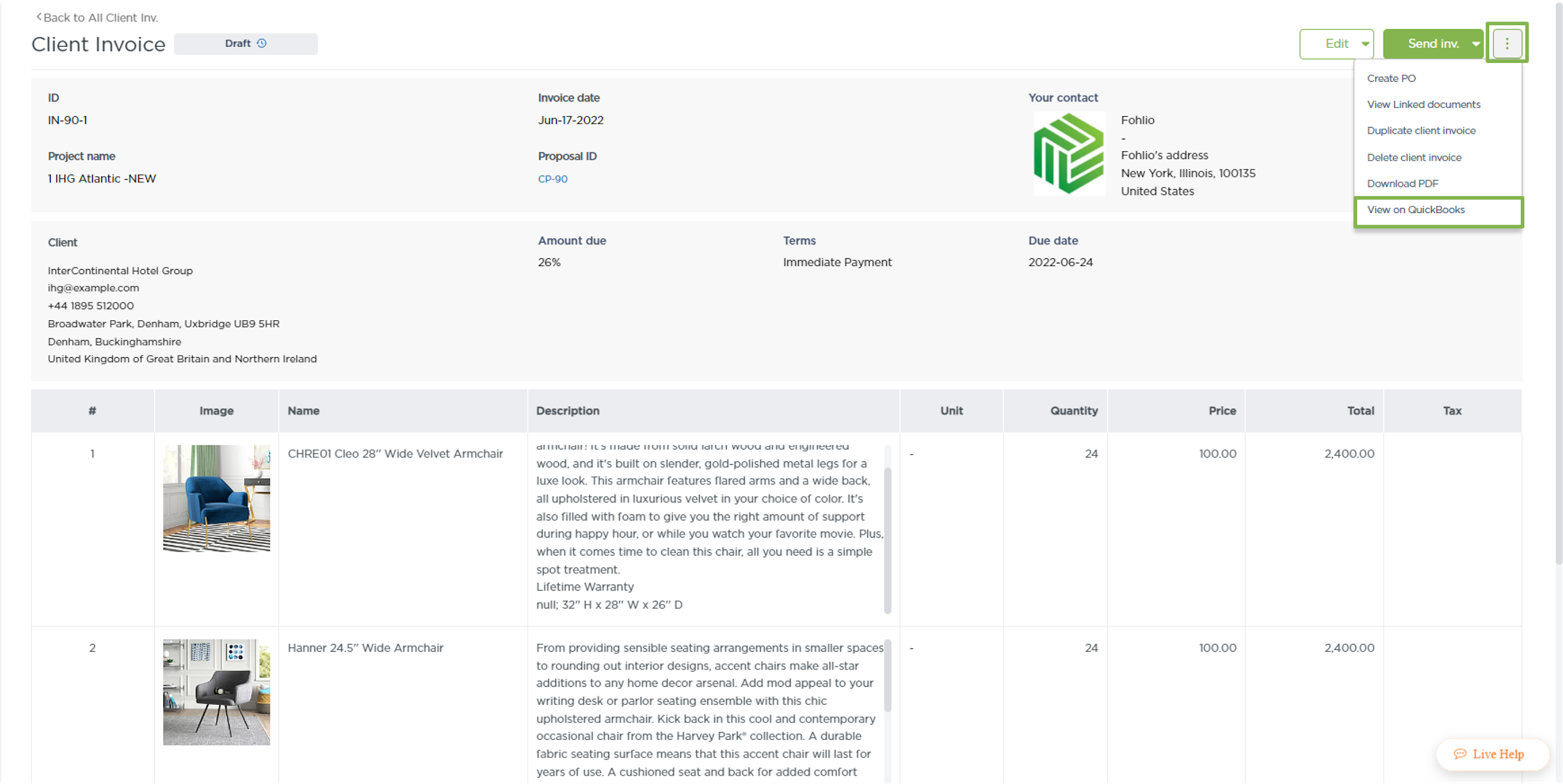

2. Click on the ⋮ icon and then select Send to Quickbooks

3. Click on the ⋮ icon and then select View on Quickbooks

Note: The same document will open on Quickbooks

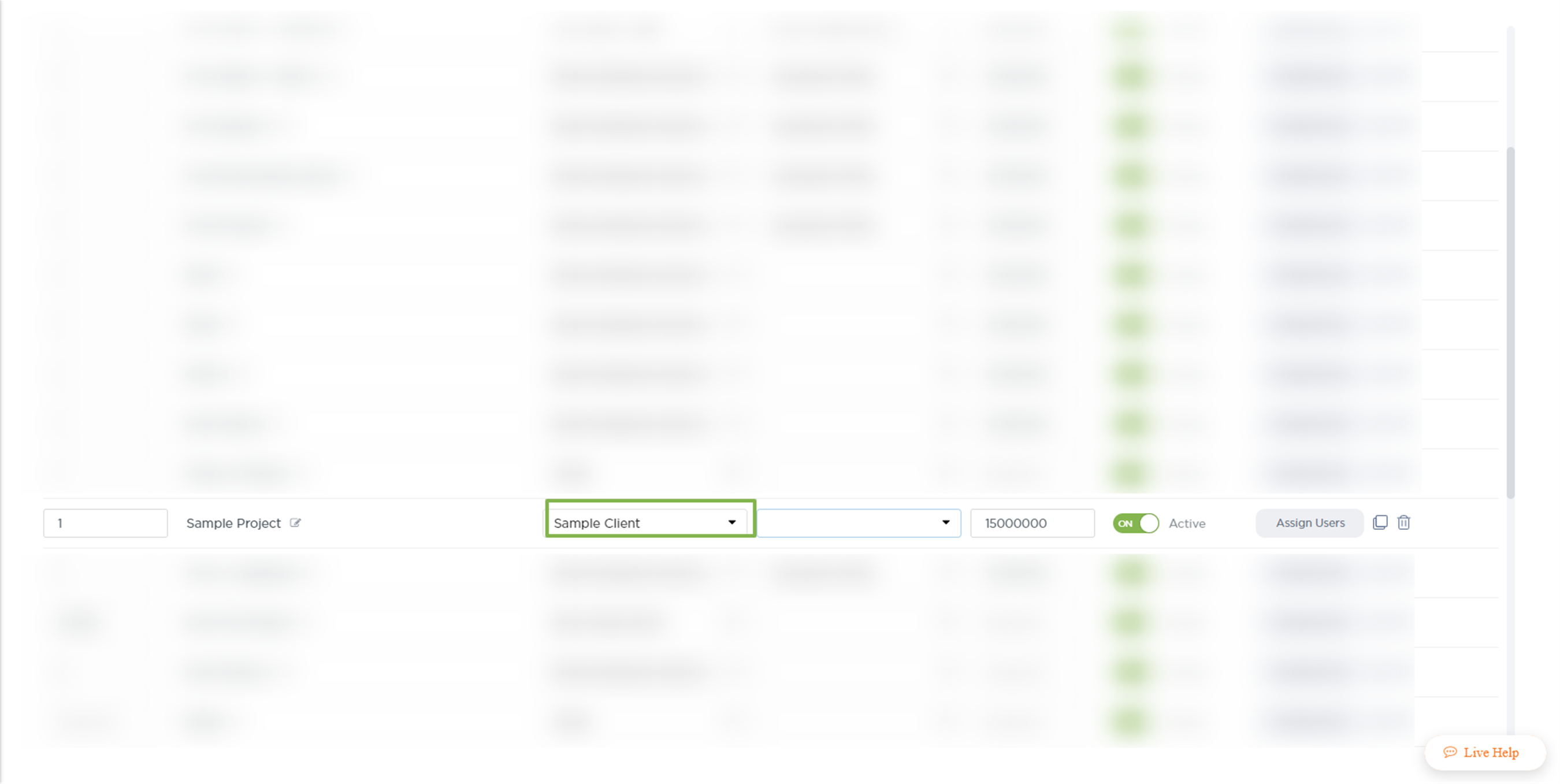

Optional: Linking your Fohlio project to a Quickbooks project

Note: This step is completely optional and it can be skipped if you do not use Projects in Quickbooks.

-1.png)

1. Access the Quickbooks tab on the Procurement Settings page.

2. Next to the Project Name at the top of the screen, you will see that there is the option to select a QBO project.

-

The projects need to be assigned to the same client/customer in both Fohlio and Quickbooks.

-

In order to have the same client on both platforms, a Client Proposal or Client Invoice needs to be sent to Quickbooks from Fohlio first, then assign the project to the new client created

The projects need to be assigned to the same client/customer in both Fohlio and Quickbooks.

In order to have the same client on both platforms, a Client Proposal or Client Invoice needs to be sent to Quickbooks from Fohlio first, then assign the project to the new client created

-1.png)

3. Select one of the projects from your Quickbooks account and then click on Save at the bottom of the page.

Bonus: Frequently Asked Questions

Do you have questions that are not on the following list?

Please reach out to us using Live Help and our specialists are going to assist you.

-

Q: Are those settings being applied to all the projects?

-

Q: Can I send documents with different currencies from Fohlio to Quickbooks?

-

Q: Does the integration work with QBO Australia or QBO Canada?

-

Q: I do not use Sales Tax, is it required in Fohlio?

-

Q: Would this integration work with Quickbooks Desktop?

-

Q: Would the item in my project be modified if I modify it on Quickbooks?

-

Q: What happens if I link the Fohlio project with a Quickbooks project?

Are those settings being applied to all the projects?

Each individual project can have different settings, meaning the settings you apply to a project, those settings affect only that project.

Note: When creating a new project, the settings of the last created project are copied.

Note: Duplicating a project copies the settings of that project.

Can I send documents with different currencies from Fohlio to QuickBooks?

In order to be able to send documents with different currencies, the Multicurrency feature needs to be enabled on Quickbooks

Does the integration work with QBO Australia or QBO Canada?

Yes, our integration works with QBO Canada and QBO Australia.

I do not use Sales Tax, is it required in Fohlio?

A tax rate needs to be created in Fohlio and linked to QBO, however, you can set it to 0% and select No Tax Agency

Would this integration work with Quickbooks Desktop?

Unfortunately, we do not offer a Quickbooks Desktop integration at the moment.

Please let us know if you would like to see an integration between Fohlio and Quickbooks Desktop.

Would the item in my project be modified if I modify it on Quickbooks?

If the item is modified on Quickbooks, it won't affect the item in the your Fohlio project.

Note: However, it will get modified on the Procurement Document that's linked to it.

What happens if I link the Fohlio project with a Quickbooks project?

If a Fohlio project is linked with a Quickbooks project, all the project procurement documents sent from Fohlio to QBO are going to be tracked inside the QBO project.

Important: Your Fohlio Contact Book will sync with your contacts on QBO

Bonus: Troubleshooting Guide

This troubleshooting guide is created in order to assist you in resolving Quickbooks errors that you might receive because of misconfigurations or certain actions on your Quickbooks account.

Please reach out to us using Live Help in case you are unable to solve a problem or if you encounter other issues that are not included in the guide.

Quickbooks Errors

-

No income/expense account selected for project or service item

-

Please go to Accounting - Settings and assign a Tax Rate Agency to your current tax rate, by clicking on the Edit icon next to the Tax rate

-

Required parameter Name is missing in the request.

-

Object Not Found: Something you’re trying to use has been made inactive.

-

The name supplied already exists. : Another product or service is already using this name. Please use a different name.

-

Stale Object Error : You and <user> were working on this at the same time. <user > finished before you did, so your work was not saved

-

The query cannot be parsed, refer to detailed message for reasons

-

You can't associate a product or service with accounts of certain types (such as Accounts Receivable and Accounts Payable). If the product or service is something you sell, use an income account. If the product or service is something you buy, use an expense account.

-

PurchaseOrder has to be enabled in Settings

-

has already been taken

No income/expense account selected for project or service item

Explanation:

All the Quickbooks transactions need to be linked with an account from the Chart of Accounts (based on the nature of the transaction).

Resolution:

Access Procurement Settings and ensure that the Income Account and Expense Account are both properly mapped

Please go to Accounting - Settings and assign a Tax Rate Agency to your current tax rate, by clicking on the Edit icon next to the Tax rate

Explanation:

Quickbooks requires that each Tax Rate is linked to a Tax Agency in order to allow you to file tax documents and for the current project, there is no Tax Rate Agency assigned to the Tax Rate.

Resolution:

Access Procurement Settings and edit the Tax Rate in order to select one of the available Tax Rate Agencies.

Required parameter Name is missing in the request.

Explanation:

The name of the product is a required field for Quickbooks as products without names cannot be created.

Resolution:

-

Ensure that the correct column is selected for Product/Service Name in Procurement Settings.

-

Check if the item used on the Procurement Document has a value for the column selected to be used as the Product/Service Name.

-

Recreate the Procurement Document after double-checking your settings.

Ensure that the correct column is selected for Product/Service Name in Procurement Settings.

Check if the item used on the Procurement Document has a value for the column selected to be used as the Product/Service Name.

Recreate the Procurement Document after double-checking your settings.

Object Not Found: Something you’re trying to use has been made inactive.

Explanation:

One of the entities (vendors, clients, accounts) has been made inactive on Quickbooks, therefore, the object cannot be updated on Quickbooks without making it active.

Resolution:

-

Check which entities are used by the Procurement Document (i.e vendor, client, account, tax rate)

-

Access Quickbooks and look for the inactivated item by using the Inactive Filter on the list of entities (i.e list of vendors, chart of accounts, etc.)

Check which entities are used by the Procurement Document (i.e vendor, client, account, tax rate)

Access Quickbooks and look for the inactivated item by using the Inactive Filter on the list of entities (i.e list of vendors, chart of accounts, etc.)

The name supplied already exists. : Another product or service is already using this name. Please use a different name.

Explanation:

All the names in Quickbooks need to be unique, this applies to products, clients, vendors, etc.

Resolution:

-

Select a column that has unique values to be used as Product/Service Name in Procurement Settings.

-

Check on your Quickbooks account if there are objects that have the same name

Select a column that has unique values to be used as Product/Service Name in Procurement Settings.

Check on your Quickbooks account if there are objects that have the same name

Stale Object Error : You and <user> were working on this at the same time. <user > finished before you did, so your work was not saved

Explanation:

One of the objects has been updated on Quickbooks before it has been updated on Fohlio.

Resolution:

Recreate the document in Fohlio and attempt to send it again to Quickbooks

Best Practice: Always make the changes on Fohlio and then sync the documents with Quickbooks

The query cannot be parsed, refer to detailed message for reasons

Explanation:

One of the names of the items included in the document contains characters that are not supported by Quickbooks.

Resolution:

Change the name of the items and exclude all the characters that are not accepted.

Here is a list of accepted characters:

-

Alpha-numeric (A-Z, a-z, 0-9)

-

Comma (,)

-

Dot or period (.)

-

Question mark (?)

-

At symbol (@)

-

Ampersand (&)

-

Exclamation point (!)

-

Number/pound sign (#)

-

Single quote (')

-

Tilde (~)

-

Asterisk (*)

-

Space ( )

-

Underscore (_)

-

Minus sign/hyphen (-)

-

Semi-colon ( ; )

-

Plus sign (+)

You can't associate a product or service with accounts of certain types (such as Accounts Receivable and Accounts Payable). If the product or service is something you sell, use an income account. If the product or service is something you buy, use an expense account.

Explanation:

The accounts were mapped incorrectly on the Quickbooks tab in Procurement Settings

Resolution:

Access Procurement Settings and change the account used for A/P Account to reflect an account that is an Account Payable in Quickbooks

PurchaseOrder has to be enabled in Settings

Explanation:

Your Purchase Orders feature is disabled in Quickbooks

Resolution:

You have to access Account and Settings - Expenses on Quickbooks and turn on Purchase Orders

has already been taken

Explanation:

A different Tax Agency has been selected for this Tax Rate in a different project and documents using that Tax Rate was sent to Quickbooks

Resolution:

Either select the Tax Agency used in another project or edit the Tax Agency used in that other project and then select that Tax Agency in the current project.

We hope this article was helpful, please rate the article, and reach us via Live Help if you still need assistance.